Brunei Darussalam has been ranked as the 46th most competitive economy – an improvement of 12 places from last year – in the World Economic Forum’s (WEF) global competitiveness index for 2017-2018, which was released yesterday.

Switzerland took the top spot out of 137 measured economies, with US in second and Singapore in third.

Brunei’s jump of 12 places is the highest change in rank amongst ASEAN member nations (pictured below), and places the Sultanate at fifth in the regional bloc; ahead of Vietnam, Philippines, Cambodia and Laos, and behind Singapore, Malaysia, Thailand and Indonesia.

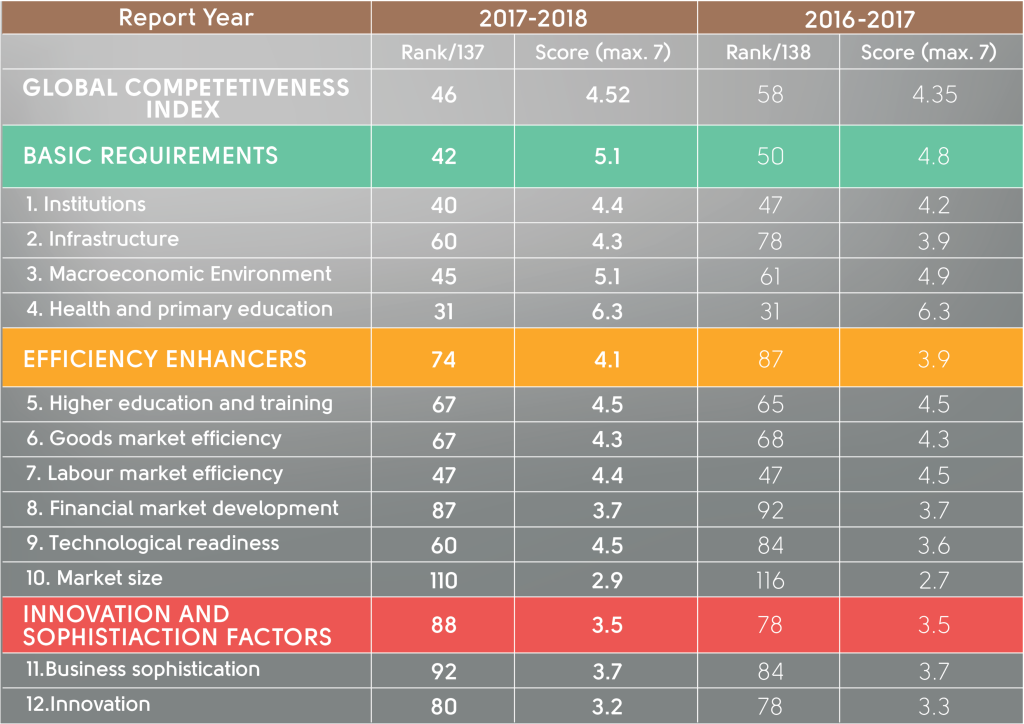

Of the 12 pillars measured by WEF, Brunei’s strongest performers fall within the basic requirement sub indices – which covers the pillars of institutions, infrastructure, macroeconomic environment and health and primary education.

Brunei’s overall score for the 12 pillars averaged to 4.52 out of 7, and amongst the four pillars under basic requirements, 5.1.

The report also highlights the most problematic factors for doing business in each economy – based off the opinions of business executives sampled in WEF’s annual Executive Opinion Survey.

Brunei’s three main challenges were access to financing, inefficient government bureaucracy and poor work ethic in national labour force.

The Global Competitiveness Report series remains the most comprehensive assessment of national competitiveness worldwide. It defines competitiveness as the “set of institutions, policies, and factors that determine the level of productivity of an economy, which in turn sets the level of prosperity that the country can earn.”

The 12 pillars of competitiveness measured are institutions, infrastructure, macroeconomic environment, health and primary education, higher education and training, goods market efficiency, labour market efficiency, financial market development, technological readiness, market size, business sophistication and innovation.

A press statement from the Ease of Doing Business (EODB) Unit under the Energy and Industry Department at the Prime Minister’s Office said that business reforms to streamline inefficient government processes, ensure cost of doing business is competitive and that regulations are aligned with international best practices are being actively monitored and driven by His Majesty’s Government through the EODB Steering Committee.

EODB added that initiatives focused on easing Foreign Direct Investments (FDIs) into Brunei has seen the establishment of the FDI Action and Support Center (FAST) – responsible for the fast-track facilitation of projects and coordination within the different investment agencies.

This has resulted in a healthy influx of FDI into Brunei, most notably the USD 12 billion commitment by Hengyi Industries to develop the second phase of its Pulau Muara Besar refinery and petrochemical plant, which makes Brunei as the destination of its largest foreign investment to date.

“Improving the business environment and ultimately Brunei Darussalam’s global competitiveness is a key priority of His Majesty’s Government to ensure Brunei Darussalam can sustain its trajectory of economic growth towards achieving Wawasan 2035, with greater collaboration and transparency between public and private sector now being a key success factor to stimulate growth in the non-oil and gas sector,” said EODB in their statement.

The Global Competitiveness Study was carried out in Brunei in March until May this year, with a greater number of participation by companies, giving their feedback through the survey.

The participating companies range from Foreign Direct Investors, Government-linked Companies as well as Small and Medium Enterprises across various sectors of the economy such as oil and gas, agriculture, retail, logistics and communications.

The graphs contained within this story have been sourced directly from the Global Competitiveness Report. You can access the full report here.