If you have knowledge, why not share it?

COBLAS, or Consulting Based Learning for ASEAN SMEs in short, is a workshop aimed at providing businesses with skills and foresight to anticipate and overcome economic, financial and logistical challenges.

Organised by muBn Learning and Growth Company, the inaugural two-week programme, held at iCentre recently, was led by a team of international consultants from Japan, Malaysia and Singapore.

“With consultancy-based learning, it will help drive Brunei as a knowledge hub with homegrown experts to support businesses in their ventures,” said by it’s pioneer innovator, Dr Takeru Ohe of Waseda University.

How does COBLAS work?

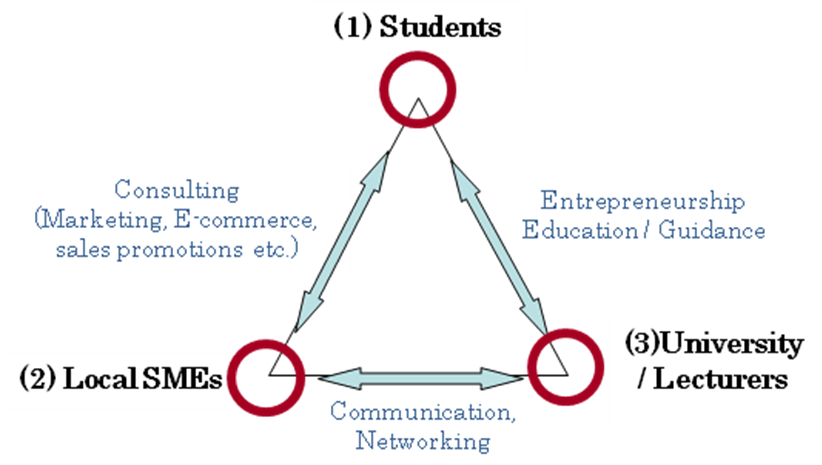

As an interlinking system, COBLAS works by connecting local SMEs, students and lecturers through a combination of interactions by means of consultation, guidance and communication.

The method works by using analytic tools that have the ability to evaluate how robust a businesses is in the context of the local economy. It can also be used by those looking to set up a business in a different country entirely.

The method works by using analytic tools that have the ability to evaluate how robust a businesses is in the context of the local economy. It can also be used by those looking to set up a business in a different country entirely.

Essentially it’s using sound business principles and knowledge specific to the economy you operate in – allowing you to make the informed decision on what strategies should be used.

What are the tools involved?

These are the nine tools used by COBLAS to validate the suitability of your business:

- Business Model for preferred year goal: with a table chart, you should define the inner-working of your business that would provide for your product and services. These elements include the following:

- Customer Segment – which specific customers are you catering to?

- Value Proposition – what is unique about your product?

- Channel – what is the medium of distribution/selling?

- Customer Relationship – is your product/service one-off or long-term?

- Revenue – what is the source of income for your business?

- Resources (Solution) – product – what problem it solves??

- Main Activities – what kind of routine actions would be undertaken in the business?

- Partner – what kind/type of partnership do you need? E.g. private limited or proprietorship?

- Cost Structure – identify the different types of fixed and variable expenditures in your business

- SWOT Analysis: is an acronym for Strengths, Weaknesses, Opportunities and Threats. With your business model in mind, SWOT is used within the following two analyses – PEST and Five Forces. These allow you to factor external environments and the competitiveness of your business.

- PEST Analysis: stands for Political, Economic, Social/Cultural and Technological. The analysis here aims to gauge opportunities and threats of these four environmental factors that would affect the functioning of your business long-term.

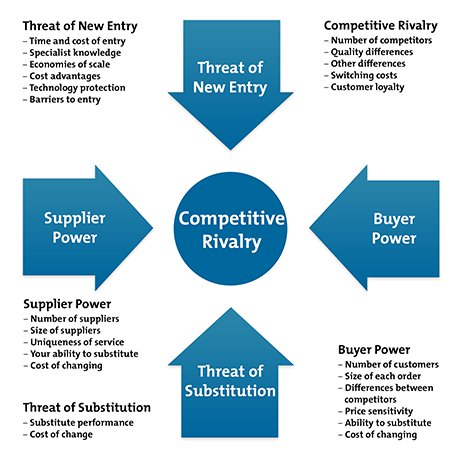

- Five Forces Analysis: looks into influencing factors that examine the current economic environment and determine competitive power of price-setters i.e. suppliers, competitors and buyers, as well as threats of new entrants and substitutes.

- Cross SWOT Analysis and Action Plan: with the outcome of PEST and Five Forces, the two most important strong and weak factors respectively can be used to cross check across your strength-weaknesses and opportunities-threats. This will help you make decisions to leverage on the strong points of your business while adjusting your initial model to reduce foreseeable threats in your long-term plan.

- Attribute Map: the measure of your current product/service to the complexity of your customers’ needs and wants. Cross referencing between basic, discriminating or energizing features of your product/service against the potential positive, negative and neutral reactions of your customers.

- Consumption Chain: is another strategy to evaluate the current approach of your customers’ experience of a particular product or service in it’s life time.

- Business Model Ohe (BMO): a calculator used to determine the attractiveness and fitness of your business model. Designed by Dr Ohe, the scale breaks down a scorecard for each key items and the overall robustness of your business model at it’s current state and the attractiveness of your product/service within the industry in the long-term.

- Reverse Financials: is a causal model to put money into perspective to project your business model. Based expenses involved in running the business, you will be able to create a reverse income statement and reverse balance sheet. This will help you manage assumptions and work backwards from your goals to project your returns and avoid unnecessary losses.

Interested to participate in a COBLAS course? Register with muBn at +673-897 8685 or email mubn.lgc@gmail.com. You can find out more on their website at http://www.mubn.co/ for more information on their services.